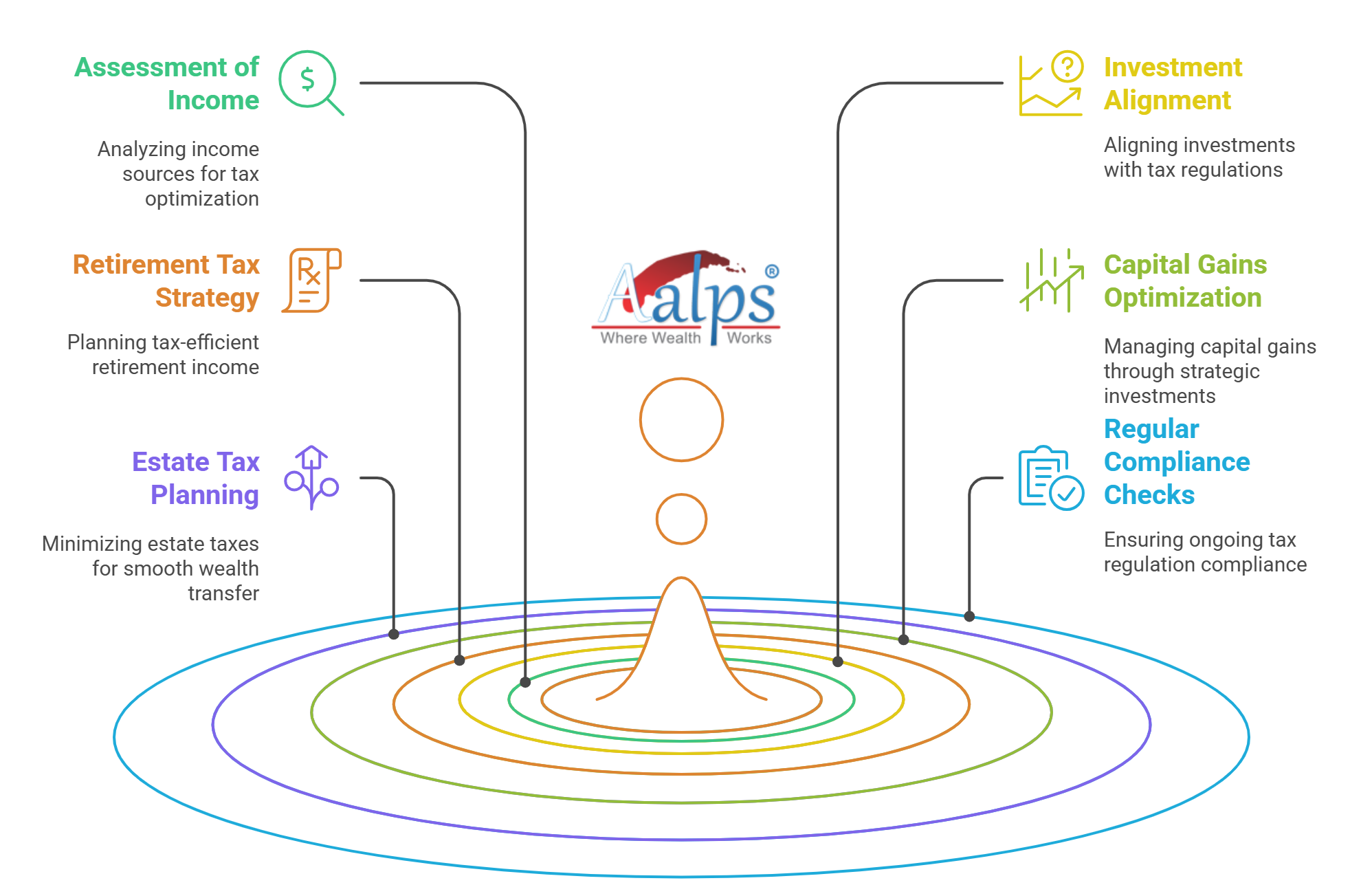

Tax planning is a vital part of your financial planning. Efficient tax planning enables you to reduce your tax liability to the minimum. This is done by legitimately taking advantage of all tax exemptions, deductions rebates and allowances while ensuring that your investments are in line with your long-term goals. At Aalps Wealth, we understand the importance of strategic tax planning to optimize your financial position. Our Taxation Planning Service is designed to provide comprehensive solutions tailored to your individual needs.

Conduct a meticulous income tax analysis to enhance financial efficiency by optimizing tax liability through a thorough examination of income sources.

Designing tax-efficient investment strategies by aligning investment plans with regulations, ensuring minimized tax liabilities for optimal financial outcomes.

Suspendisse accumsan imperdue ligula dignissim sit amet vestibulum in mollis etfelis.

Strategically plan for tax-efficient retirement income, ensuring a financially secure and optimized approach to your post-retirement financial well-being.

Receive expert advice on strategic investment decisions to minimize capital gains tax, ensuring efficient management of your investment portfolio.

Suspendisse accumsan imperdue ligula dignissim sit amet vestibulum in mollis etfelis.

Taxation planning is vital for optimizing financial outcomes, minimizing liabilities, and strategically managing tax implications for sustainable financial health.

Aalps conducts a comprehensive analysis of income sources, developing personalized taxation strategies aligned with individual financial goals and risk tolerance.

Yes, Aalps specializes in formulating tax-efficient retirement plans, considering various income sources and lifestyle goals to minimize tax implications during retirement.

Aalps provides proactive assistance, guiding clients through the complexities of tax regulations and reporting requirements to ensure compliance and minimize risks.

Aalps designs investment strategies that align with tax regulations, providing opportunities for tax efficiency while pursuing individual financial goals.

Aalps addresses various taxes, including income tax, capital gains tax, estate tax, and more, ensuring a comprehensive approach to taxation planning.

Aalps provides guidance on strategic investment decisions to manage capital gains tax efficiently, maximizing returns while minimizing tax liabilities.

Yes, Aalps offers taxation planning services for businesses, optimizing tax strategies to enhance financial efficiency and compliance.

Regular reviews are recommended, and Aalps supports ongoing adjustments to taxation plans to adapt to changing circumstances and regulations.

Aalps stands out with its expertise in crafting personalized taxation strategies, providing transparent guidance, and ensuring clients’ overall financial well-being.