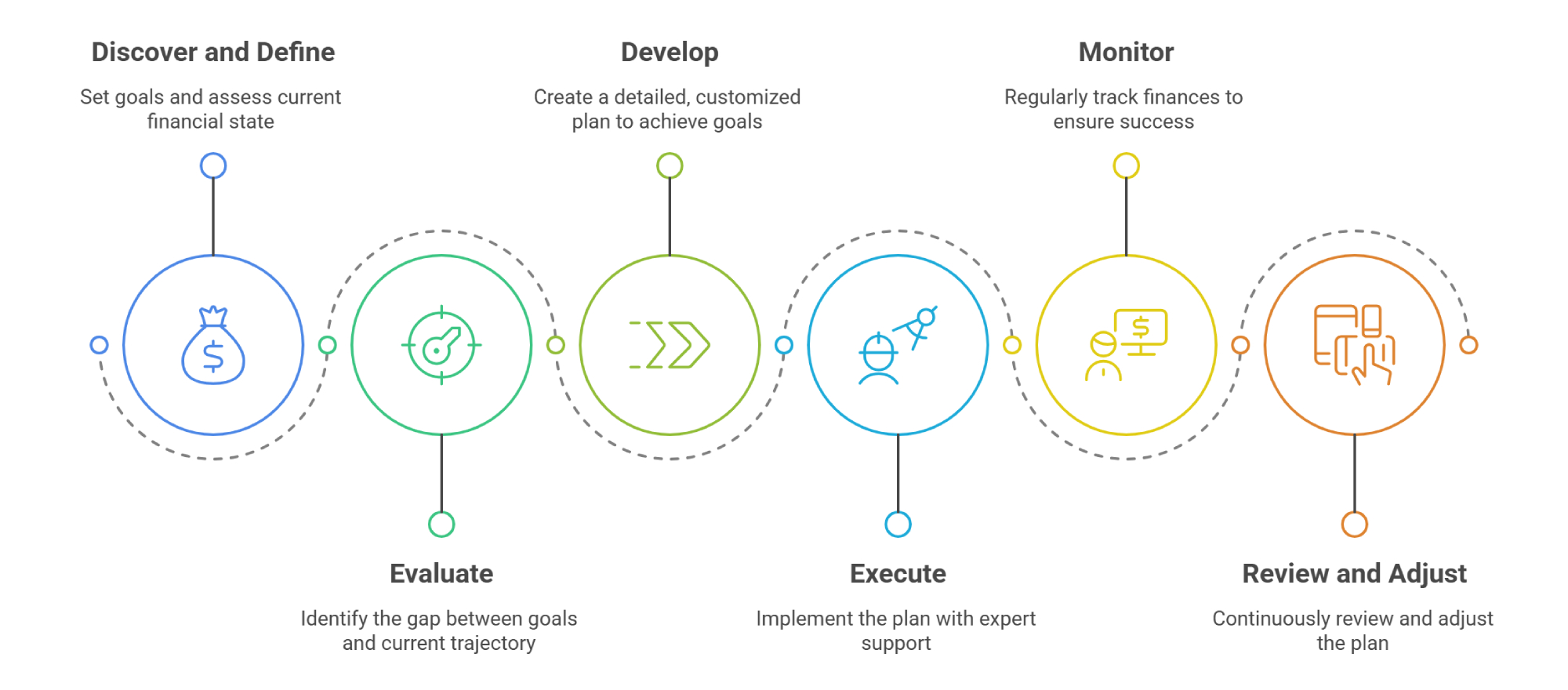

Financial Planning is the strategic process of aligning your life goals with your available resources. At Aalps, we follow a systematic six-step approach, as defined by the Financial Planning Standards Board of India, to organize and manage your financial affairs. Our focus is on your life goals, such as Retirement Planning, Higher Education Fund for your children, and more. We specialize in Mutual Funds while offering a diverse range of capital products, including Insurance, Govt. Bonds, Fixed Deposits, Structured Products, and Tax Saving Plans.

Customize your financial journey with goal-based planning for retirement, education, weddings, and vacations—ensuring a tailored and prosperous future.

Receive expert guidance in accounting, including income/expense analytics and tax strategy advisory for optimal financial management and strategic planning.

Access personalized insurance advice for home, health, and term policies—ensuring comprehensive coverage and financial security tailored to your specific needs.

Diversify your portfolio with strategic allocation across stocks, bonds, and mutual funds—optimizing returns and managing risk for financial success.

Navigate estate planning with expert advice on wills and trusts—ensuring a secure and thoughtful approach to preserving and distributing assets.

Manage real estate effectively with our services covering sales and rental management—ensuring seamless transactions and maximizing returns on property investments.

Financial planning is crucial for setting and achieving life goals, optimizing resources, and ensuring long-term financial well-being.

Aalps conducts a thorough assessment of individual goals, risk tolerance, and financial circumstances, customizing plans for a personalized approach.

Aalps provides goal-based planning, accounting advisory, insurance advisory, portfolio allocation, estate planning, real estate services, and more.

Aalps specializes in risk assessment and mitigation, ensuring that financial plans are aligned with individual risk tolerances for optimal outcomes.

Yes, Aalps integrates tax-efficient strategies within financial plans to maximize savings and optimize overall financial performance.

Regular reviews are recommended, and Aalps supports ongoing adjustments to ensure plans remain aligned with changing circumstances and goals.

Aalps incorporates inflation into financial strategies, aiming to maintain the purchasing power of assets and income over the long term.

Goal-based planning ensures that financial strategies are tailored to meet specific objectives, such as retirement, education, and wealth accumulation.

Aalps formulates retirement plans, considering income sources, lifestyle goals, and tax efficiency to secure a comfortable and financially stable retirement.

Aalps stands out with its customized, client-centric approach, encompassing a range of services and a commitment to ongoing support for comprehensive financial well-being.