Given the number of funds available in the market it becomes difficult for an investor to identify the appropriate scheme that will match his needs. Mutual funds ensure diversification within and across asset classes, across securities, across geographies and also across fund managers. Diversification is an inevitable part of any investment strategy. At Aalps Wealth, our MF service is tailored to align with your financial goals. Explore the benefits of investing in Mutual Funds with us.

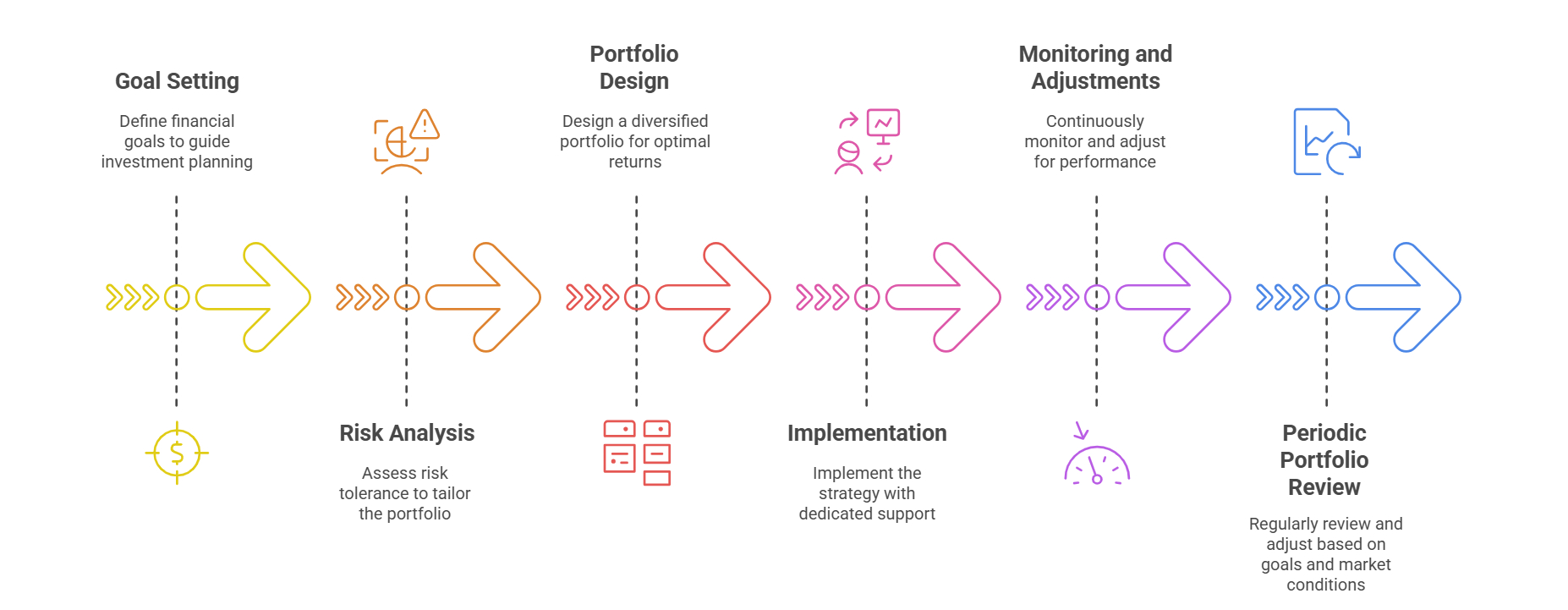

Crafting goal-oriented Mutual Fund plans tailored to align with specific financial objectives, ensuring a personalized and strategic approach to investments.

Skillful curation of a diversified portfolio, strategically managing risks and maximizing returns for an optimal and balanced investment strategy.

Suspendisse accumsan imperdue ligula dignissim sit amet vestibulum in mollis etfelis.

Conducting thorough risk analysis to customize Mutual Fund selections based on your risk tolerance, ensuring a personalized and secure investment approach.

Designing tax-efficient Mutual Fund strategies, aligning with regulations to optimize efficiency and provide advantageous financial outcomes for investors.

Suspendisse accumsan imperdue ligula dignissim sit amet vestibulum in mollis etfelis.

Mutual Funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers.

Mutual Funds offer diversification, professional management, and accessibility to various asset classes, making them an efficient investment option for a broad range of investors.

Aalps tailors Mutual Fund portfolios based on individual financial goals, risk tolerance, and investment preferences. This customization ensures alignment with unique objectives.

Mutual Funds carry market risks, and the value of the fund can fluctuate. Aalps specializes in risk assessment and mitigation to guide investors in selecting suitable funds.

Yes, Aalps designs Mutual Fund strategies considering tax regulations, providing opportunities for tax efficiency while pursuing your financial goals.

Regular reviews are essential. Aalps recommends periodic evaluations to ensure your Mutual Fund portfolio aligns with your changing financial circumstances and goals.

Aalps provides a range of Mutual Funds, including equity, debt, and hybrid funds, catering to diverse risk appetites and investment preferences.

Yes, Mutual Funds offer liquidity. Aalps ensures a seamless redemption process, providing flexibility for investors to access their funds as needed.

Aalps employs a strategic approach, guiding clients through market fluctuations, providing insights, and making necessary adjustments to optimize performance.

Aalps is transparent about fees, which typically include management fees and expenses. We provide clear information on costs to ensure informed investment decisions.